Residential depreciation calculator

Then it automatically calculates depreciation for either residential or commercial rental properties based on the users choice. Depreciation on an investment residential property cant the deducted from income tax.

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

. A building shall be deemed to be a building used mainly for residential purposes if the built-up floor area thereof used for residential. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. An interest vested in this also an item of real property more generally buildings or housing in general.

BMT Tax Depreciation Calculator. Deemed depreciation rate cars. In that case you should use an investment property depreciation calculator to get at least a general idea about the tax deductions you can claim in your tax return.

They agreed that only improvements and replacements to plant and. It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties. For residential household and personal items lifespan will vary depending on the quality of materials and workmanship frequency of use or misuse storage conditions and care.

Estimate depreciation deductions for residential investment properties and commercial buildings. In terms of law real is in relation to land property and is different from personal property while estate means. Rental property depreciation is generally straightforward.

For cars purchased on or after 10 May 2006 the depreciation rate is 25. Form 8283 Non-cash Charitable Contributions. Well you can use this tool to compare three different models of macrs depreciation that are the 200 declining balance 150 declining balance and straight-line method over a GDS Recovery.

Find out more about FBT for employers in Chapter 75 Operating cost method. Check e-file status refund tracker. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Property depreciation for real estate related to MACRS. Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below.

Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. The diminishing value depreciation rates are used for car fringe benefits valued under the operating cost method.

Washington Brown are Quantity Surveyors in Australia providing expert Depreciation Schedules and a FREE tax depreciation calculator - Try Now. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. Sum-of-Years Digits Depreciation Calculator.

Immovable property of this nature. A list of commonly used depreciation rates is given in a. It will calculate straight line or declining method depreciation.

Experts depicted that the value of the building only can be depreciated. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. The new rules allow for 100 bonus expensing of assets that are new or used.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20. A depreciation schedule is the best way to ensure the biggest tax refund possible.

Cant do it without TurboTax. Find out the effective life and depreciation rate for any residential or. To calculate your depreciation divide your property value by 275 and you get the amount of depreciation youre allowed to claim each year.

And depreciation Julie84 - MI. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. These assets had to be purchased new not used.

Real Estate Property Depreciation Calculator. Above is the best source of help for the tax code. Use a Tax Depreciation Calculator.

A BMT Tax Depreciation Schedule covers all deductions available over the lifetime of a property. Get 247 customer support help when you place a homework help service order with us. This lets us find the most appropriate writer for any type of assignment.

DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne. The macrs depreciation calculator is specifically designed to calculate how fast the value of an asset decreases over time. Form 5695 Residential Energy Credits.

These items have been filtered to our Appliances - Major category. The most common method of calculated depreciation the General Depreciation System spreads depreciation equally over a term of 275 years for residential buildings. Therefore according to the Australian tax law you can claim tax deductions on.

MACRS Depreciation Calculator Help. If you only own the property for a portion of the year the depreciation is calculated based on how many months of the year you own it. The Depreciation Calculator computes the value of an item based its age and replacement value.

The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. 10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real property. Suppose you need to calculate the depreciation of your property.

You can use our depreciation calculator. BMT Construction Cost Calculator. Remember that residential rental property is depreciated at a rate of 3636 percent per year for 275 years.

The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Form 6251 Alternative Minimum Tax. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

Depreciation is a tax deduction available to property investors. A depreciation report on your Australian Residential property within 14 working days or well reduce the fee by 50. If you own residential property for the full year divide your cost basis by 275.

Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. However both new and old properties will hold some depreciation benefits.

Call Us Today 1300 990 612. It is a common myth that older properties will attract no depreciation claim. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

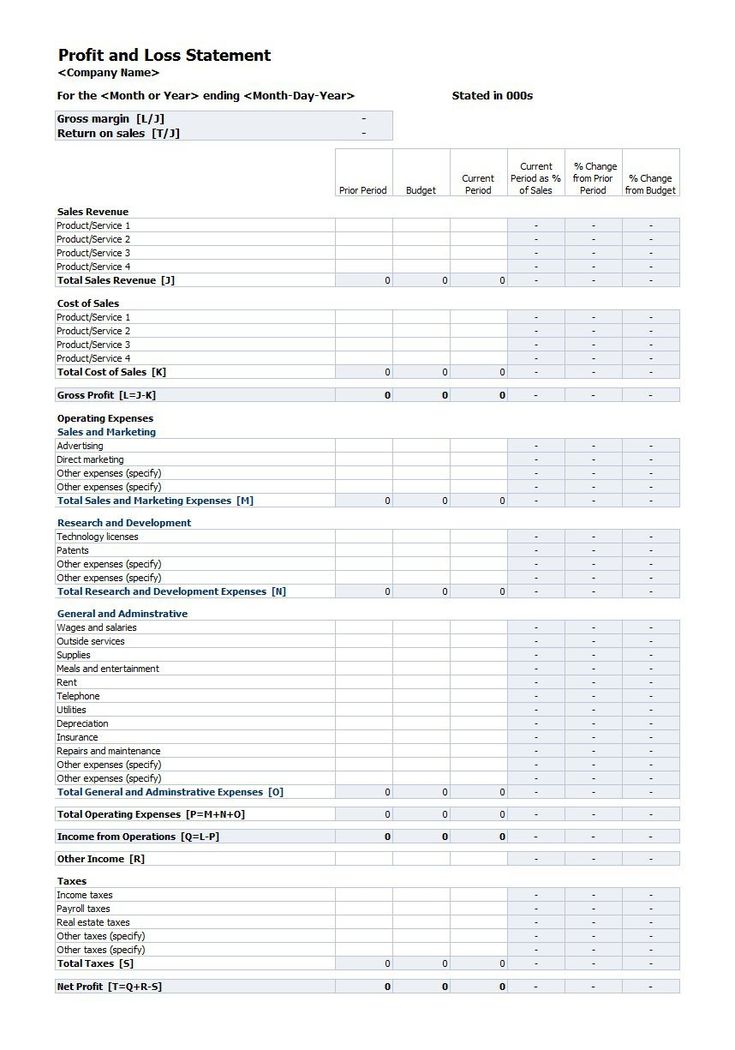

Profit And Loss Template 07 Profit And Loss Statement Statement Template Spreadsheet Template

City Hotel Financial Model Dynamic 10 Year Forecast

How To Increase The Roi Of Your Real Estate Investment Portfolio Epic Real Estate Investing Podcast Infographic Real Estate Real Estate Real Estate In

Expense And Profit Spreadsheet Profit And Loss Statement Statement Template Cash Flow Statement

Gross Domestic Capital Formation Mind Map Investing Domestic

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Loan Repayment Schedule Investing Investment Property

Prabhupremgroup Believes In Building A House With Every Brick Of Trust Visit Us Http Www Prabhupremgro Building A New Home Attleborough Building A House

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Smats Have A Fantastic Australian Property Tax Calculator Thats Free To Use Property Tax New Property Names

Untended Depreciation Schedule Sample Schedule Templates Schedule Schedule Template

Why The 2 Percent Rule Matters For Rental Property Investing Under 30 Wealth Renting Out Your House Real Estate Investing Rental Property Rental Property Management

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Who Says You Cant Buy Happiness When You Can Buy Your Own Home Prabhuprembuildcon Prabhuprem Group Family Values Gaming Logos This Is Us

Inventories Office Com List Template Free Business Card Templates Business Template

General Journal Template Excel Elegant General Ledger Spreadsheet Spreadsheet Template Business Template Small Business Bookkeeping

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income

Komentar

Posting Komentar